0

$

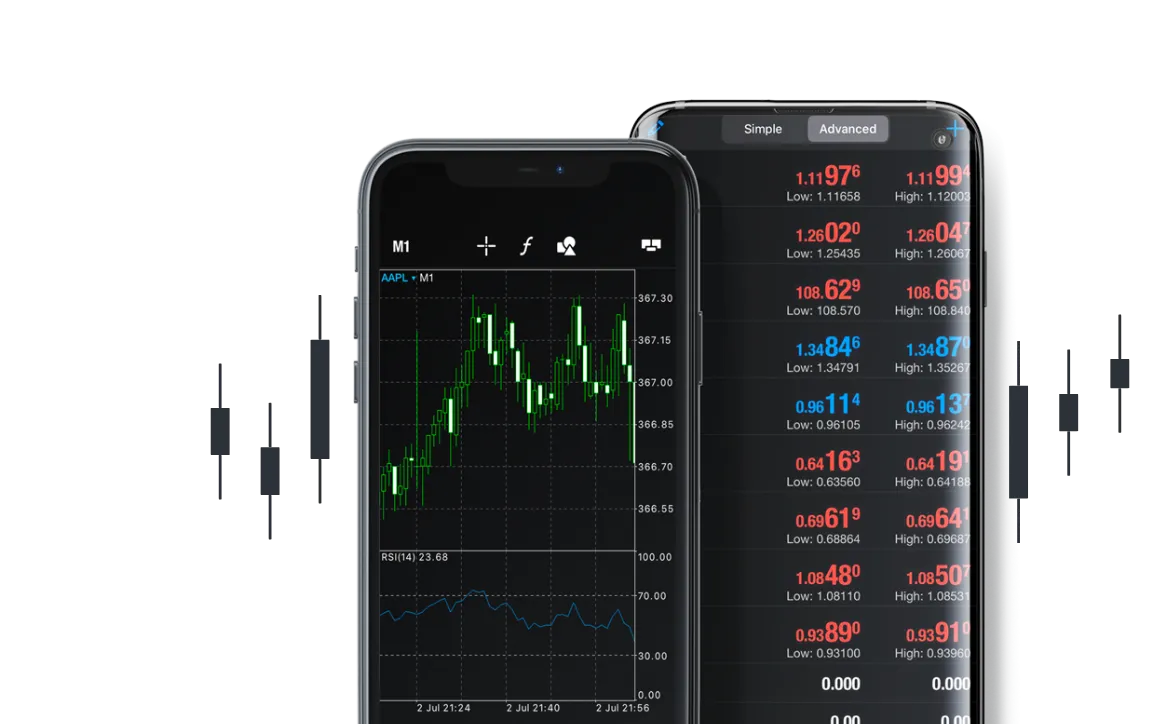

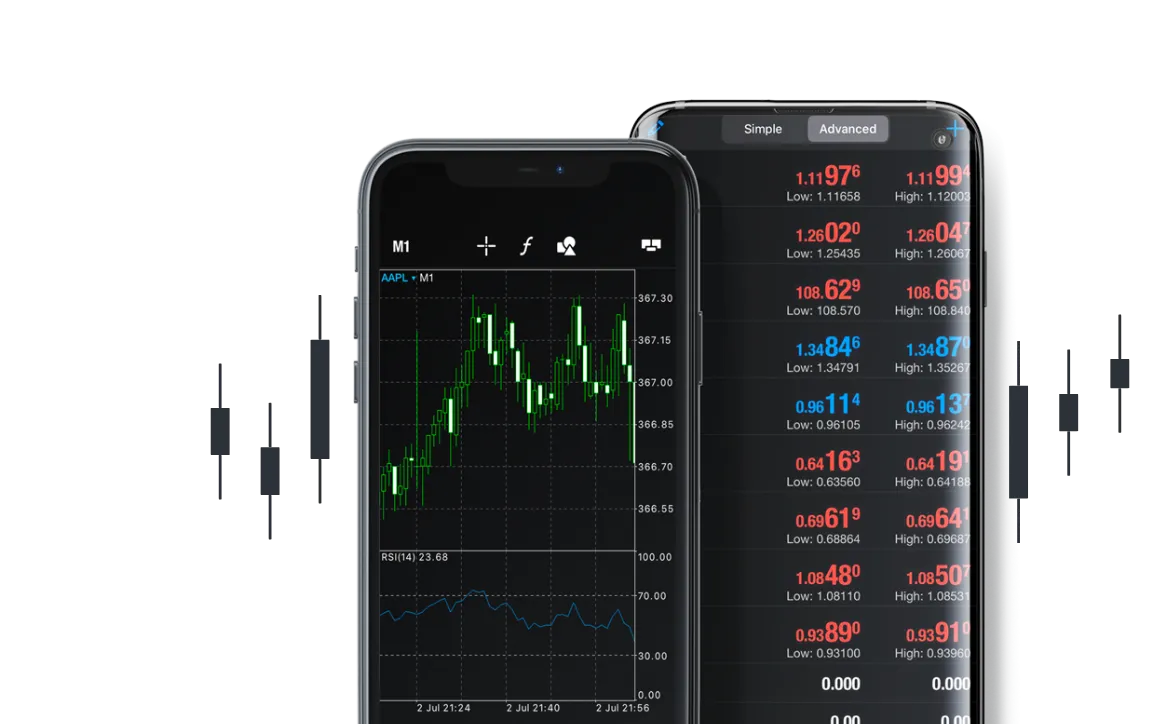

META TRADER 5

Join an award-winning program with the best conditions on the market

Discover all there is to know about Oslo Capitals and explore potential partnership opportunities.

META TRADER 5

Join an award-winning program with the best conditions on the market

Discover all there is to know about Oslo Capitals and explore potential partnership opportunities.

Oslo Capitals made funding and withdrawal of funds even easier with the Oslo Capitals Wallet. You can now transfer funds between your Oslo Capitals Wallet and trading accounts at any time.

Read moreUse these trading levels to fix your possible losses or profit automatically.

Read moreMake more informed decisions according to the publications of the important data.

Read moreBy keeping your money safe and secure in your Wallet, you are limiting your risk. You can choose to invest as much as you willing to risk, keeping the remainder safe in your Oslo Capitals Wallet.

Stop Loss (SL) is an order that helps to limit the losses and manage the risks of the transaction. In fact, this is a straight line, which is set at a specific level. If the price goes against you and touches Stop Loss, it will work, the position will be closed.

Take Profit is the order to fix your trading benefit automatically when the price reaches a predetermined level.

You can finish the trade at any time by clicking the Close button, or wait until the Take Profit level is triggered.

How to set it: when opening a Long position, Take Profit should be higher than the current price. When opening a sale, TP should be lower than the current price. As a rule, it is set 2 times farther from the open price level than Stop Loss.

As soon as the position is finished, your net profit or loss will be immediately reflected on the trading account balance.

Stop-loss/Take Profit does not guarantee that your position will close at a specified price. With a sharp and intense market movement, the price may slip past the level you set:

Note that you can close the trade at any time by clicking the Close button or wait until your SL or Tp is triggered.

when opening a Long position, Take Profit should be higher than the current price. When opening a sale, TP should be lower than the current price. As a rule, it is set 2 times farther from the open price level than Stop Loss.

As soon as the position is finished, your net profit or loss will be immediately reflected on the trading account balance.

Open the Economic Calendar at oslocapital.com and find news with two or three exclamation marks. At the moment of the actual statistic data publication, it immediately appears in the rightmost column. It also indicates the publication time, the name of the indicator, its description, the previous and predicted value.

This means that approximately 15 minutes before the actual value of the indicator appears in the calendar, very strong unpredictable upward or downward movements may begin on the currency pair chart.

For the Novice traders, the focus may be on the difference between the actual value and the forecast. It is a good starting point to understand the behaviour of the market during the data publication.

Stop Out is a forced automatic closing of all trader’s positions in case his trading account balance falls below the margin close-out protection level. The behavior of the assets prices is difficult to predict, and therefore it is not recommended to leave open positions over Saturday and Sunday. If you do not want to experience unpredictable Stop Out.

Lots are used to represent the trade volume in units. One standard Lot on Forex is equal to 100,000 units of the base currency of the pair. So, for EUR/USD 1 lot is 100,000 euros, for USD/JPY 1 lot is 100,000 US Dollars.

Thanks to online brokers, mini and micro-lots are also available to traders.

The table below will help you to understand lot sizes:

Standard Lot (1.0) = 100,000 of base currency

Mini Lot (0.1) = 10,000 of base currency

Micro Lot (0.01) = 1,000 of base currency

For other assets, each ‘Lot’ represents a standard amount, for example, 1 lot of Gold is 100oz. You can find the standard lots for each asset in the Oslo Capitals website specifications.

The lot size also determines the value of each pip/tick, which is covered in a separate lesson.

At Oslo Capitals all account types allow trade size from 0.01 (micro) and upwards.

Leverage multiplies traders’ buying power, allowing investors to control a larger investment than their capital, potentially increasing their returns while only investing a percentage of the overall value of the asset in question.

However, if you don’t use leverage wisely, it is possible to lose the entire Equity in a very short space of time and you may not even notice it!

Therefore, leverage is a double-edged sword, and you need to consider how much risk you are willing to take.

The leverage available to you may vary depending on your Jurisdiction, please refer the Oslo Capitals ‘’Leverage Information’’ for details.

Leverage is often described as being ‘’borrowed’’ funds from the broker, however, this is not technically accurate, because the broker does not add funds to your account, instead, the funds required to place each trade is reduced by the level of leverage you set.

For example, if you trade 1 lot of EURUSD, (worth €100,000), with leverage of 1:1 (no leverage), you will need to physically have 100k euros in your account to place this trade.

If you have leverage, let’s say of 1:10, then €10,000 will be required to place the same trade, and so on…

Let’s go through some examples to help you understand how it is implemented in practice.

Let's look at two possible scenarios.

Scenario A: with an initial investment of €1000 and leverage of 1:100 (for each euro, you have a buying power of 100), you can open a position of €100,000. Let’s say you ‘’Sell’’ EUR/USD, and the price chart moves down by 100 pips, this means that your profit will be $1000*

*Depending on the ‘’Term’’ currency of the pair

Scenario B: With an initial investment of €1000, you decide to open a ‘’Buy’’ position of €100,000 on EUR/USD. However, instead of increasing, the chart drops 100 pips. It this case, your deposit of €1000 may be lost.

During volatile markets and when using excessive leverage, it is possible for your deposit to disappear almost instantly. This is why it is so important to understand leverage and risk, and its relationship with margin and free margin, which we will discuss in the next lesson.

It is important to understand that using leverage not only magnifies potential profit or loss, but also impacts any costs associated with the trade.

For example, let’s say the spread to trade on a certain product is 0.1%, with the price currently at $1000.

A client with a $1000 deposit and who trades using no leverage (1:1), will incur a spread of $1, which represents 0.1% of the deposited capital. If the client instead traded, for example, using a leverage of 1:10, the spread would be $10 or 1% of the deposited capital.

The same applies to rollover fees, commissions or any other trading costs.

The above is just a basic example, to illustrate how leverage has a higher impact on your invested capital, as this is an important concept to understand.

Let’s recap the important points from this lesson:

Invest only amounts you are willing to lose in unfavourable situations.

Try to use all the opportunities of the 6 assets classes for successful risk management.

Choose your perfect match among 50+ technical indicators available on the Oslo Capital platforms.

Become a part of Oslo Capitals community: read daily analytics, examine educational tips and share your Oslo Capitals experience with other traders

Adding {{itemName}} to cart

Added {{itemName}} to cart