0

$

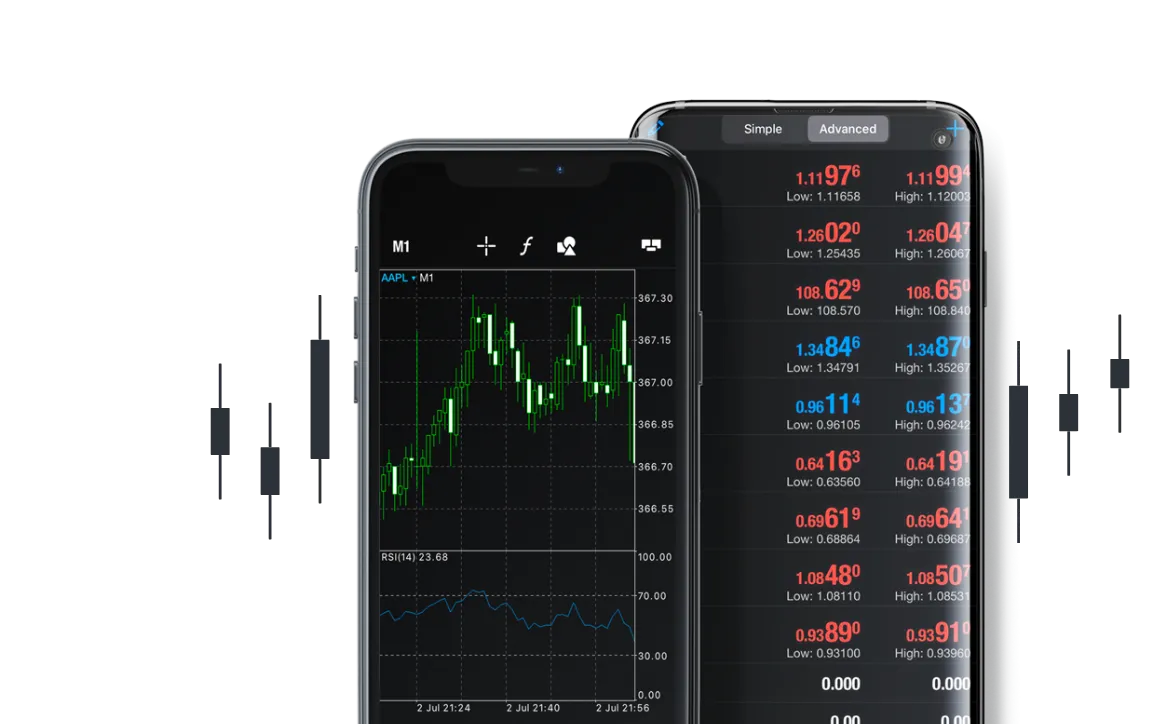

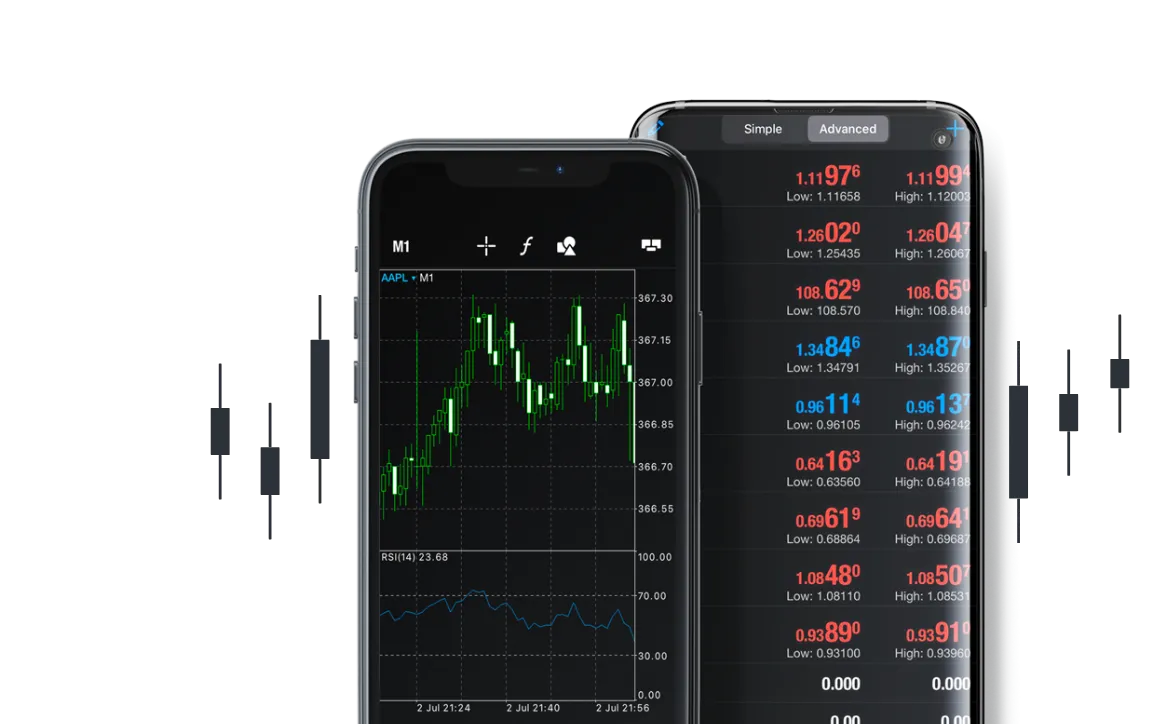

META TRADER 5

Join an award-winning program with the best conditions on the market

Discover all there is to know about Oslo Capitals and explore potential partnership opportunities.

META TRADER 5

Join an award-winning program with the best conditions on the market

Discover all there is to know about Oslo Capitals and explore potential partnership opportunities.

Oslo Capitals understands that competitive swap rates are important to any trader.

At Oslo Capitals clients have the flexibility to trade by using the same margin requirements and leverage from 1:1 to 1000:1.

Oslo Capitals’s margin requirements and leverage are based on the total equity in your account(s) as described below:

| Leverage | Total Equity |

|---|---|

| 1:1 to 1000:1 | $5 — $40,000 |

| 1:1 to 500:1 | $40,001 — $80,000 |

| 1:1 to 200:1 | $80,001 — $200,000 |

| 1:1 to 100:1 | $200,001 + |

Margin is the amount of collateral to cover any credit risks arising during your trading operations.

Margin is expressed as the percentage of position size (e.g. 5% or 1%), and the only real reason for having funds in your trading account is to ensure sufficient margin. On a 1% margin, for instance, a position of $1,000,000 will require a deposit of $10,000.

For Forex, Gold and Silver, new positions can be opened if the margin requirement for the new positions is equal or less than the free margin of the account. When hedging, positions can be opened even when the margin level is below 100% because the margin requirement for hedged positions is Zero.

For all other instruments, new positions can be opened if the margin requirement for the new positions is equal or less than the free margin of the account. When hedging, margin requirement for the hedged position is equal to 50%. New hedged positions can be opened if the final margin requirements will be equal or less than the total equity of the account.

At Oslo Capitals, leverage on Cryptocurrency CFDs is dynamic and adapts automatically based on the volume traded on each instrument. This means that, as the trade volume per instrument increases, the margin percentage also increases, relevant to the dynamic leverage value of each instrument.

Also, it is important to note that margin calculations are done per instrument traded. So, when a client has open positions on multiple instruments, the margin is calculated separately on each.

In the examples below, you can see how dynamic margin is calculated. Kindly note that the values in the tables are for illustrative purposes only and should not be used for making trading calculations.

Examples:

| Lots | Dynamic Margin Percentage | Leverage |

|---|---|---|

| 0-40 | 0.2% | 500:1 |

| 40-120 | 0.4% | 250:1 |

| 120-200 | 2% | 50:1 |

| 200+ | 100% | 1:1 |

Example 1: Client trades 10 lots of BTCUSD at 25,000 USD opening price, with USD account base currency.

| Lots | Dynamic Margin Percentage | Actual Used Margin |

|---|---|---|

| 10 | 0.2% | Lots * Contract Size * OpenPrice * MarginPercentage = 10 * 1 * 25,000 * 0.2 % = 500 USD |

| Total Margin = 500 USD |

Example 2: Client trades 50 lots of BTCUSD at 25,000 USD opening price, with USD account base currency.

| Lots | Dynamic Margin Percentage | Actual Used Margin |

|---|---|---|

| 40 | 0.2% | Lots * Contract Size * OpenPrice * MarginPercentage = 40 * 1 * 25,000 * 0.2 % = 2,000 USD |

| 10 | 0.4% | Lots * Contract Size * OpenPrice * MarginPercentage = 10 * 1 * 25,000 * 0.4 % = 1,000 USD |

| Total Margin = 3,000 USD |

Example 3: Client trades 210 lots of BTCUSD at 25,000 USD opening price, with USD account base currency.

| Lots | Dynamic Margin Percentage | Actual Used Margin |

|---|---|---|

| 40 | 0.2% | Lots * Contract Size * OpenPrice * MarginPercentage = 40 * 1 * 25,000 * 0.2 % = 2,000 USD |

| 80 | 0.4% | Lots * Contract Size * OpenPrice * MarginPercentage = 80 * 1 * 25,000 * 0.4 % = 8,000 USD |

| 80 | 2% | Lots * Contract Size * OpenPrice * MarginPercentage = 80 * 1 * 25,000 * 2 % = 40,000 USD |

| 10 | 100% | Lots * Contract Size * OpenPrice * MarginPercentage = 10 * 1 * 25,000 * 100 % = 250,000 USD |

| Total Margin = 300,000 USD |

In cases where the account leverage is below the leverage value of the traded instrument, leverage decreases to meet the account leverage value.

In the examples below, you can see how dynamic margin is calculated and restricted by account leverage. Kindly note that the values in the tables are for illustrative purposes only and should not be used for making trading calculations.

Examples:

BTCUSD

| Lots | Dynamic Margin Percentage | Leverage | Account Leverage | Leverage Used | Used Dynamic Margin Percentage |

|---|---|---|---|---|---|

| 0-40 | 0.2% | 500:1 | 100:1 | 100:1 | 1% |

| 40–120 | 0.4% | 250:1 | 100:1 | 1% | |

| 120–200 | 2% | 50:1 | 50:1 | 2% | |

| 200+ | 100% | 1:1 | 1:1 | 100% |

Example 4: Client trades 210 lots of BTCUSD at 25,000 USD opening price, with USD account base currency, and account leverage 100:1.

| Lots | Dynamic Margin Percentage | Actual Used Margin |

|---|---|---|

| 40 | 1% | Lots * Contract Size * OpenPrice * MarginPercentage = 40 * 1 * 25,000 * 1 % = 10,000 USD |

| 80 | 1% | Lots * Contract Size * OpenPrice * MarginPercentage = 80 * 1 * 25,000 * 1 % = 20,000 USD |

| 80 | 2% | Lots * Contract Size * OpenPrice * MarginPercentage = 80 * 1 * 25,000 * 2 % = 40,000 USD |

| 10 | 100% | Lots * Contract Size * OpenPrice * MarginPercentage = 10 * 1 * 25,000 * 100% = 250,000 USD |

| Total Margin = 320,000 USD |

Using leverage means that you can trade positions larger than the amount of money in your trading account. Leverage amount is expressed as a ratio, for instance 50:1, 100:1, or 500:1. Assuming that you have $1,000 in your trading account and you trade ticket sizes of 500,000 USD/JPY, your leverage will equate 500:1.

How would it be possible to trade 500 times the amount you have at your disposal? At Oslo Capitals you have a free short-term credit allowance whenever you trade on margin: this enables you to purchase an amount that exceeds your account value. Without this allowance, you would only be able to buy or sell tickets of $1,000 at a time.

Oslo Capitals shall monitor the leverage ratio applied to clients’ accounts at all times and reserves the right to apply changes to and amend the leverage ratio (i.e. decrease the leverage ratio), on its sole discretion and without any notice on a case by case basis, and/or on all or any accounts of the client as deemed necessary by Oslo Capitals.

Depending on the account type you open at Oslo Capitals, you can choose the leverage on a scale from 1:1 to 1000:1. Margin requirements do not change during the week, nor do they widen overnight or at weekends. Moreover, at Oslo Capitals you have the option to request either the increase or the decrease of your chosen leverage.

On the one hand, by using leverage, even from a relatively small initial investment you can make considerable profit. On the other hand, your losses can also become drastic if you fail to apply proper risk management.

This is why Oslo Capitals provides a leverage range that helps you choose your preferred risk level. At the same time, we do not recommend trading close to a leverage of 1000:1 due to the high risk it involves.

At Oslo Capitals you can control your real-time risk exposure by monitoring your used and free margin.

Used and free margin together make up your equity. Used margin refers to the amount of money you need to deposit to hold the trade (e.g. if you set your account at a leverage of 100:1, the margin that you will need to set aside is 1% of your trade size). Free margin is the amount of money you left in your trading account, and it fluctuates according to your account equity; you can open additional positions with it, or absorb any losses.

Although each client is fully responsible for monitoring their trading account activity, Oslo Capitals follows a margin call policy to guarantee that your maximum possible risk does not exceed your account equity.

As soon as your account equity drops below 50% of the margin needed to maintain your open positions, we will attempt to notify you with a margin call warning you that you do not have sufficient equity to support open positions.

The stop-out level refers to the equity level at which your open positions get automatically closed. The stop-out level in a client’s account is reached when the equity in the trading account is equal or falls below 20% of the required margin.

Enhance your security by familiarizing yourself with practices that help prevent unauthorized account activities, scams, and fraud attempts.

Adding {{itemName}} to cart

Added {{itemName}} to cart